Three Days Will Reveal Global Alert Level on Inflation

Via Bloomberg,

The Federal Reserve and global counterparts are poised to take center stage in three days of monetary action that will reveal if they share the alarm about surging inflation that has gripped investors.

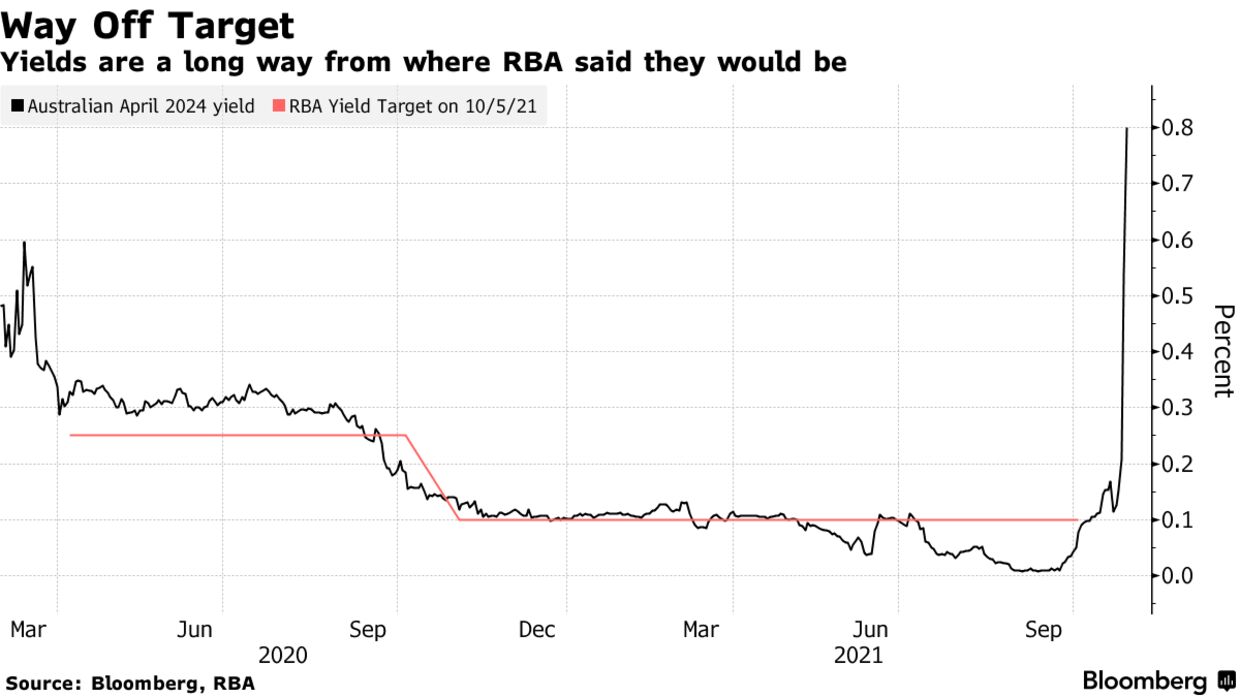

The Reserve Bank of Australia will be first, in a decision on Tuesday that is “shaping up to be a potentially market-moving one,” according to Bloomberg Economics’ James McIntyre. Officials are confronting a surprisingly strong pickup in core consumer prices, though economists expect them to avoid raising interest rates again for now.

Central Bank Decisions This Week

Note: Mapped data show rate decision schedules for distinct central banks

The Fed’s highly-anticipated meeting on Wednesday will likely kick off a tapering of asset purchases, the start of a wind-down in pandemic bond-buying flagged by Chair Jerome Powell. Economists and market participants will be watching for when the reduction will begin and how long it’ll take.

The central bank is currently buying about $120 billion of assets per month, and has pledged to maintain that pace until “substantial further progress” is achieved on both employment and inflation.

Fed officials broadly agree the latter test has been met — prices rose by 4.4% in September from a year ago, according to their preferred gauge. They’re more divided on the labor market, and maybe Friday’s U.S. payrolls report can offer a clearer view on that.

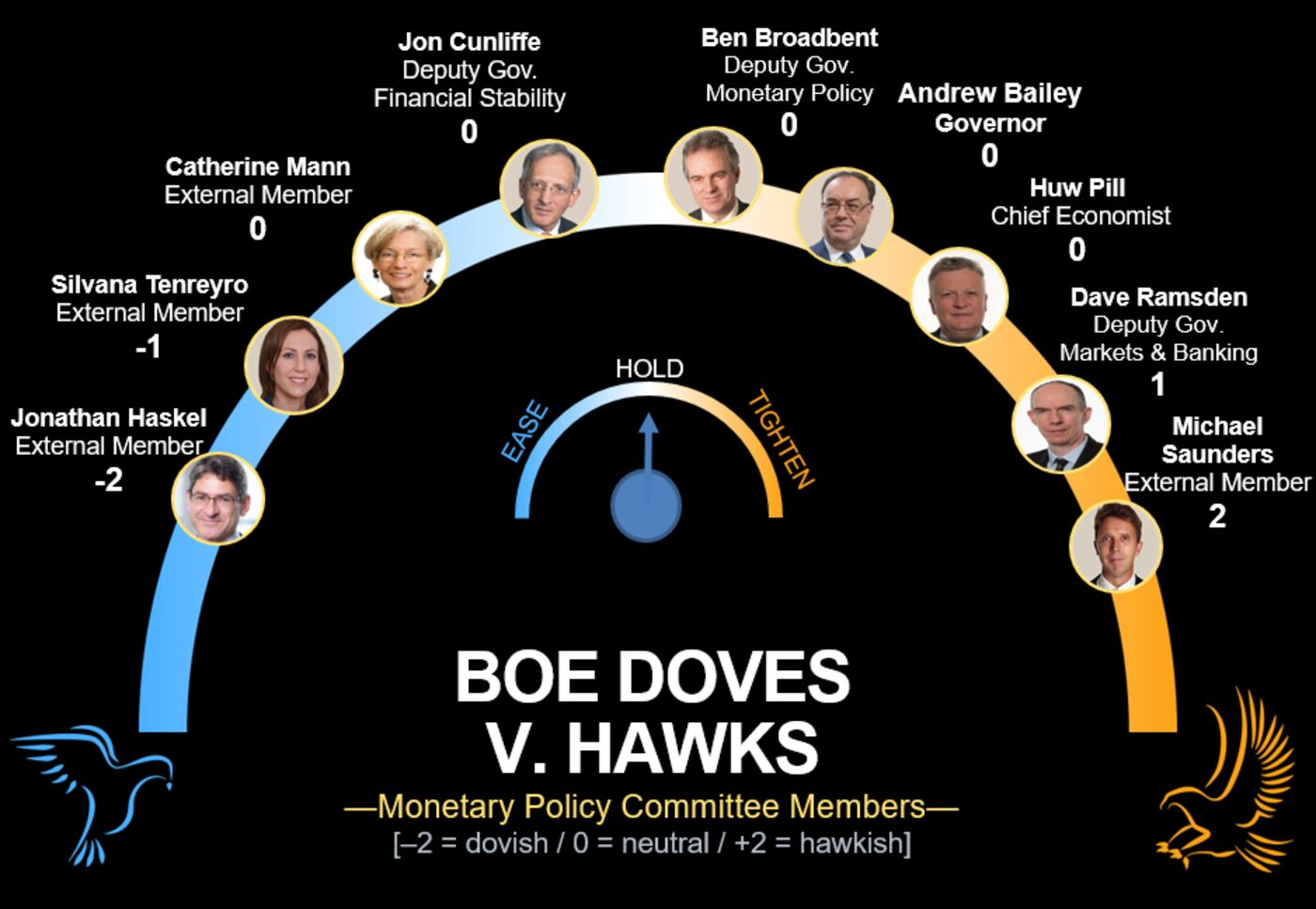

On Thursday, attention turns to the Bank of England, whose decision has become a cliffhanger after recent remarks by some officials suggested sudden concern about price pressures. Investors are betting on a hike, while economists narrowly predict no change.

What Bloomberg Economics Says:

“There’s a fierce debate raging on the Monetary Policy Committee about whether to raise interest rates next week. Financial markets think it’s a done deal, thanks to a series of hawkish interventions by Governor Andrew Bailey. We’re less sure.”

–Dan Hanson and Jamie Rush.

Those meetings are just the most prominent in a post-Halloween week when the global inflation scare will also focus other central banks. Monetary officials in Poland and the Czech Republic are expected to raise interest rates, while those in Norway are likely to signal a hike for their decision in December.

U.S.

Aside from the Fed decision, investors will also be watching key data revealing the latest state of the economy’s recovery from the pandemic.

The October nonfarm payrolls report due Friday is forecast to show a rebound in hiring after two disappointing months of job growth. While the leisure and hospitality sector may post gains amid declining Covid-19 cases, employment growth is still broadly constrained by a limited supply of workers and high rates of quitting.

Payrolls increased by 450,000 last month, more than twice as much as in September, according to the median projection in a Bloomberg survey of economists. The unemployment rate is forecast to have fallen to 4.7% from 4.8%.

Asia

Recently installed Prime Minister Fumio Kishida is expected to win Japan’s general election at the weekend. With the vote out of the way, investors and economists will be watching closely to find out what specific measures the government plans to take in support of the economy.

South Korean export figures on Monday will give the latest snapshot of the strength in global trade, especially the tech sector, as supply snags continue to complicate shipment flows.

The RBA meets to decide policy on Tuesday following an acceleration of inflation back into the central bank’s target range. That unexpected move has further fueled speculation that Governor Philip Lowe’s timeline for eventual rate hikes is way too long, though he is seen sticking to his line for the time being. A more detailed policy statement later in the week may give more clarity on the RBA’s current thinking.

Factory gauges from across the region are due Monday as electricity shortages and soaring commodity prices weigh on manufacturers. China’s PMI reports on Sunday showed that factory activity contracted for a second straight month in October.

Europe, Middle East, Africa

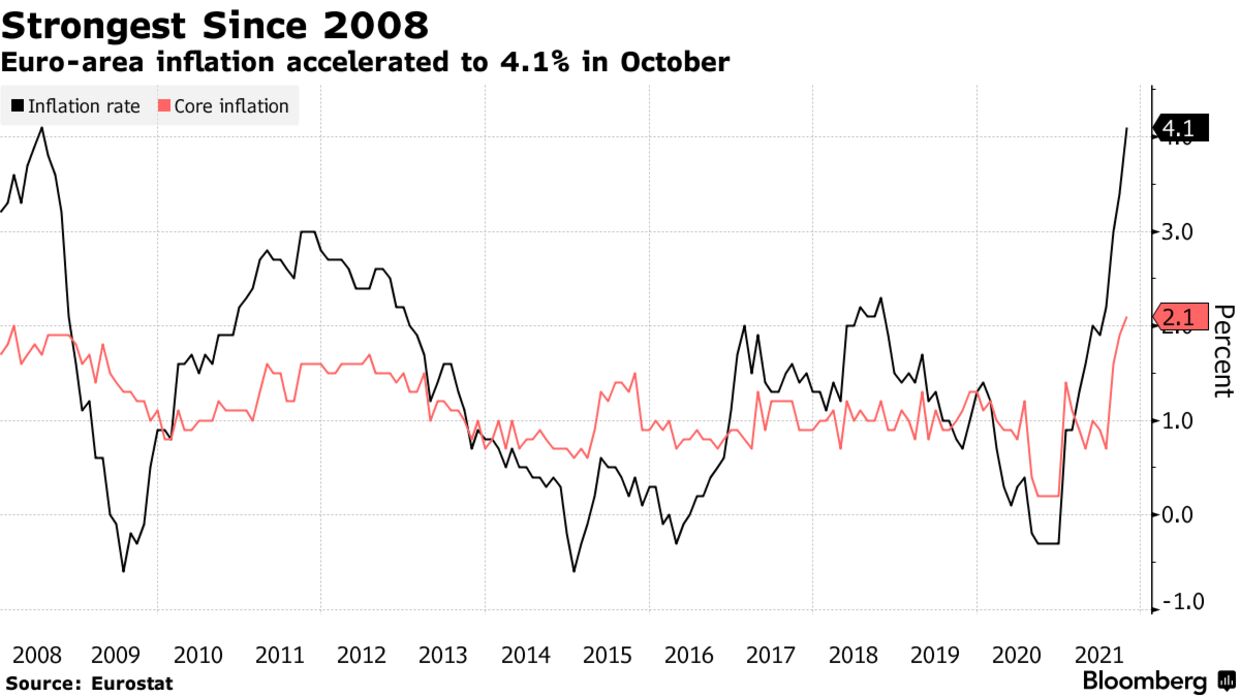

While the central spotlight will be most on the BOE and counterparts around the region from Norway to eastern Europe, appearances by European Central Bank President Christine Lagarde and colleagues may also draw the attention of investors.

The ECB last week failed to convince financial markets that it isn’t going to raise interest rates in the next year, bets that intensified after euro-zone inflation data on Friday accelerated above 4% for only the second time ever. Officials could use speaking appearances in coming days to counter such expectations.

Among euro-zone reports due, German factory orders and industrial production will reveal how global supply bottlenecks impacted the region’s biggest economy in September.

Elsewhere, Turkey will release October inflation figures on Wednesday, a few days after raising its year-end forecast to 18.4%. Urged on by the president, the central bank has lowered its benchmark interest rate by 300 basis points in back-to-back cuts, price pressures as “transitory.”

Zambia’s Finance Ministry on Tuesday will provide an update on talks with the International Monetary Fund. Africa’s first pandemic-era sovereign defaulter is seeking an economic program that will anchor debt-restructuring talks with creditors including holders of its $3 billion of foreign-currency bonds.

On Friday, data from Mauritius will likely show that inflation slowed for a third straight month in October after peaking at 6.5% in July, giving the central bank room to hold the key interest rate at its final meeting of the year in December.

And in Russia, inflation due on Wednesday will show just how far price growth continues to exceed the central bank’s target, potentially signaling yet more rate hikes in the coming months after the unexpectedly big rise on Oct. 22.

Latin America

A report out Monday may show that prices in Peru’s capital, Lima, eased in October for the first time since April.

Downturn

Inflation in Peru’s capital of Lima is forecast to have slowed in October

Sources: Instituto Nacional De Estadistica E Informatica De Peru; Banco Central de Reserva del Peru; Bloomberg.

On Tuesday, Colombia’s central bank publishes the minutes of its Oct. 29 meeting that saw policy makers raise the key rate by a half percentage point to 2.5%.

Chile’s GDP-proxy figures, which have exceeded expectations since February, published Tuesday probably registered double-digit growth for a sixth month in September.

Boom Times

Chile’s economy has rebounded out of recession on massive stimulus

Source: Banco Central de Chile.

Brazil’s central bank on Wednesday posts the minutes of last week’s meeting where it delivered its biggest interest rate hike in almost two decades to push the Selic to 7.75%.

Inflation is more than 600 basis points above target, and President Jair Bolsonaro has big spending plans ahead of next year’s election. The central bank says investors should expect a second straight 150 basis-point hike Dec. 8.

Data out Thursday may show Brazil’s industrial output fell for a fourth month in September on supply-chain disruptions and rising electricity prices.

Colombia on Friday reports October inflation figures. Analysts see it ending 2021 at 4.9% and 3.5% next year.