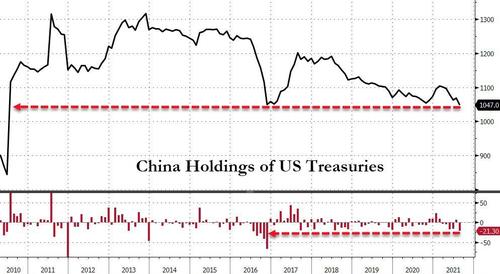

China’s US Treasury Holdings Plunge

Zerohedge

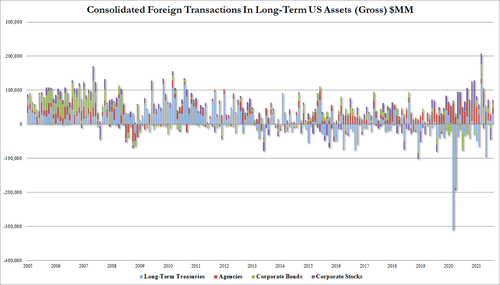

Foreign holdings of U.S. government debt rose in August to a record $7.56 trillion as demand from Japan sent that nation’s stockpile to a fresh all-time high. There was net buying across all the asset-classes:

- Long-Term bonds: August +$30.7BN, vs +$10.2BN in July

- Corporate stocks: +$8.7BN, vs -$34.3BN

- Corporate Bonds: +$14.7BN, vs -$11.0BN

- Agencies: +$17.7BN, vs +$20.7BN

Although none of it was dramatic:

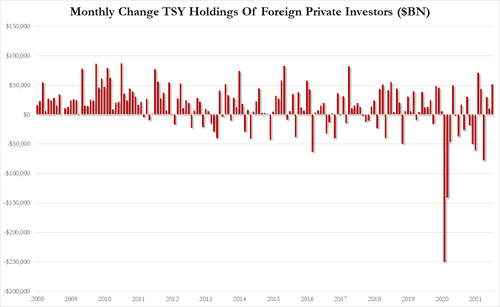

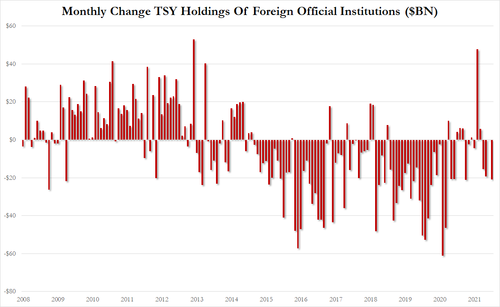

But the headline misses some nuance as foreign central banks and reserve managers (oil exporters) dumped a lot of Treasuries, down $20.9BN but Private entities bought a whopping $51.6BN – the second biggest buy since Aug 2018.

In fact foreign central banks have dumped USTs for 4 straight months…

As we mentioned above, Japan was Augist’s big buyer of USTs, pushing its overall holdings to a record high…

Source: Bloomberg

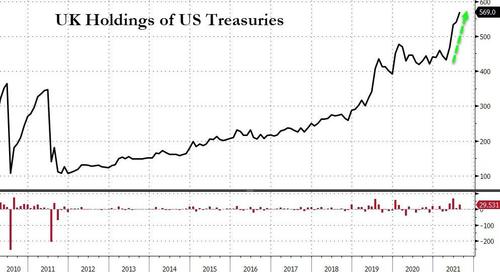

And UK was also a major buyer – also pushing its holdings to a record high…

Source: Bloomberg

But the big headline was the fact that China dumped over $21 billion of Treasuries in August (the latest TIC data), cutting its overall holdings to the lowest since August 2010…

Source: Bloomberg

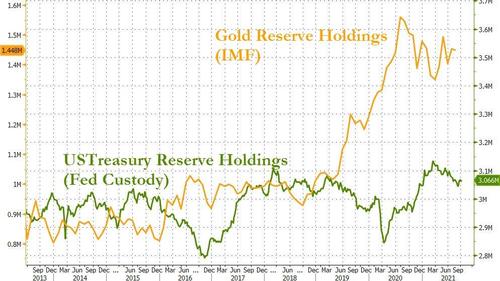

And there’s no sign of any unwind in the de-dollarization trade…